Somebody, somewhere, at some point decided they would destroy the competition by creating a barrier to entry. They made the barrier high so they could feel safe. It is logical to put a fence around your property, and perfectly fine to do so. The problem is when you put a regulatory fence over something that means you are not allowing anyone else to have a property like this. Just to make the distinction clearer a fence around your house is creating a cost for other people to get in the yard. A license to be able to have a fence is creating a cost for anyone to protect their yard. The harder to attain and costlier the license is the more people can’t afford it. The more people who can’t afford it the bigger the divide between rich and poor. You can’t have a fence because you can’t have a license leaving your yard unprotected. The poor people are left unprotected and they get robbed easily, the rich are hard to get so they keep what they have. The more licenses/regulatory compliance someone has to comply with the more the costs for them are increased and the cycle of dividing is entrenched.

When constructing something physical, regulatory oversight is sensible to ensure structural integrity, particularly when people no longer build things for themselves. However, when it comes to more abstract concepts like licenses and credentials, possessing them doesn’t guarantee success, and lacking them doesn’t preclude doing excellent work. The whole point of the series is that the work should speak for itself and the people who did it should build their reputation based on their work history not on theory.

Let’s dive into a sector full of licenses for abstract things that keep people out and cornered the market. The betting industry.

The incentive structure in this scenario is problematic. Individuals with substantial financial resources that were gained illegally may seek friendly relationships with those responsible for issuing licenses. Obtaining a betting license now can serve as a means to launder money acquired unlawfully. Beyond mere laundering, they have a direct incentive to continue their illegal activities and a way to legitimize the funds. So they steal from the people who work and it gets even worse. Their scaling solution is to open the money laundering to other illegal actors.

A few parts of the economy are primed for these types of activities: the lottery, casinos, and sports betting.

Let’s start with the current lottery system and the “potential” exploits. Well, one person does something illegal and has stolen $1,000,000. Now he has a problem with how to legitimize the funds so he can spend it on things he wants. He goes to the owner of a lottery and says I will give you $200,000 if you give me an $800,000 winning ticket. Now 80% of the funds become legal. The person with the illegal funds buys $200,000 worth of tickets from which 1 of them is set up to win $800,000. Now all the funds have become legal. So the lottery company has a $200,000 income and $800,000 payout, seemingly paying out the winner with legitimate funds, but in reality, using the criminal’s own money – correction, other people’s stolen money. That is good for hiding taxes and the state is not getting anything, or is it?

The state gets its cut for every winning ticket by taxing all winners. Because of this income, they are incentivized to have more winners. This whole “hypothetical” system then is limited by how much money has to be laundered. More illegal money, more income for each side – the state, the illegal player, the lottery company. While they get the big winning tickets the public is left with the small prizes and they are robbed continuously for the next lottery “prizes”. This tripod system demonstrates how one simple thing can be a continuous erosion of society. The lottery company does nothing to earn their money but they are incentivizing the illegal actors to continue doing illegal things. The State allowing licenses keeps competition out. The illegal actor closes the circle of his business.

The lottery should be something that is played without anyone having an advantage over anyone else. Including the company, there shouldn’t be a barrier for people creating all sorts of lottery games. The same model of behavior incentives is applicable for all the casinos. There is the same principle – some type of algorithm determines whether you win or not. But you can always approach the casino owner and apply the same logic to the casino. A player with illegal funds has to launder a million dollars again. In the first few hands, he wins a million dollars and keeps playing until incurs losses amounting to $200,000 and then stops. This way the casino loses $800,000 on its balance sheet but in reality, the illegal funds are distributed to the casino and the illegal actor.

In the sports betting industry, the barrier to entry is often determined by licenses, and companies typically act as custodians of the funds when users place bets. Additionally, these companies are responsible for providing betting odds, a task that incurs substantial costs when done accurately. Assessing various factors such as team performance, player injuries, and changes in management helps determine the odds. However, it’s crucial to note that the odds provided by betting companies are designed to favor the company rather than the individuals placing bets. This inherent bias in odds contributes to the company’s profit margin in the betting business.

Exploring a free and ethical approach to lottery apps and innovative payout structures

The whole lottery system should be verifiable! The point of it is not to have yet another system where the poor are preyed upon. That is why the lottery app should be open-sourced. The bigger reason for the apps to be FOSS – I am reluctant to say how this particular app should be created because, on the one side, there are going to be regulatory people who want you to ask for approval, and on the other side there are betting companies that a percentage of them are involved in criminal activities. If you create an app that makes them obsolete you will find yourself being attacked legally, illegally, and anything in between. That is why the only option that I see for a small guy to not be a target is to create this app as a FOSS (free and open source software). This will create a problem for those entities because there is no target. It will have no barriers for others to create apps competing with the existing incentives. There was a big debate in my head about whether I should publish this article about this particular topic because of the ethically sticky situation. Also, I do not think that people should play with money and bet on stupid things. The main reason that I am doing this is that there should not be an incentive to do illegal activities but there should be a cost for it. Since the current system is incentivizing it, people should create the cost for them by making a free alternative (no licenses, or permissions from anyone) and with no risk for the players (non-custodial). Also, the cases that we will look at below as a payment structure are simply cool and unique that we have yet to experience anywhere. This will push even us at Breez to create and facilitate them if the need is there. Now let’s take a look at the potential solution and what I envision it could look like.

An algorithm can be designed where individuals purchase a virtual ticket, and once 100 participants acquire tickets, the entire pool is distributed among three randomly selected winners. The distribution comprises 50% for the first prize, 30% for the second, and 20% for the third. The concept of a physical ticket is eliminated; instead, participants contribute equal amounts of satoshis to a smart contract, which activates upon reaching the 100th participant. The executed contracts allocate 50% to the first-place winner, 30% to the second, and 20% to the third. No entity holds funds for others, and participants await the completion of the 100 spots to determine the three winners. You can do the lottery for more or fewer people. For different amounts of sats. With a different payout structure.

I envision a lottery game modeled after the hashing race in Bitcoin mining. Participants are required to guess a number between 1 and 1,000,000 by locking in 10 satoshis for each guess. If the guessed number is incorrect, that specific guess is eliminated from the potential answers, and the satoshis from all guesses contribute to the Jackpot for the correct number. The participant who correctly guesses the number receives the accumulated satoshis. The payout amount depends on the position of the correct guess, for example, if it occurs on the 10th try, the prize is 100 sats, and if on the 100,000th try, the prize is a million sats. Upon completion of the payout, the game resets, and participants can engage in the next round.

Revolutionizing one-on-one Betting with trustless payouts

When I am with a friend, we can choose to place a bet on something–our favorite sports team, who can spit the furthest, or whether the sun will rise tomorrow. We are perfectly able to do so with cash, and we do not need a license from anyone to place those bets or determine the odds for us. There is only one problem that we have to handle when the results are in – the person who is losing the bet has to pay the winner. Because of this risk, you need a trusted third party that is unbiased to execute the payment when the results are known. Now you need a mitigation for the third-party risk–that they won’t run away with the money. So you make a fourth party involved to determine who can have a license to be a trusted third party, and we are back to the current fiat operational model.

With instant settlement and smart contracts, we destroy all those problems.

- You do not need a license for trust because no one is holding money for anyone else.

- You do not need a trusted third party because you have a smart contract responsible for the execution of the payment when the results are known

- You do not need a third party to determine the odds because they are decided by the people and put in the smart contract

- You do not need to trust the person to pay when you win because he signed the execution of the payment when both of you placed the bet.

This structure for one-on-one betting is already implemented with a few games in the lightning space. One is from our friends at THNDR games and another is the Chain Duel. I like the infrastructure for the payment of the THNDR games because I am a sucker for non-custodial lightning. Custody for a second, a minute or a year is still custody.

What would a sports betting app look like that has a non-custodial instant settlement? There are a few easy settings to establish. First, there needs to be a deadline for placing bets before the sports event starts. Second, a timeframe must be set for the payout. In one-on-one betting, the payout structure is straightforward. Each side can wager any amount against the other, and if there is a disparity in the amounts, the odds are not 1:1. When the result is determined, the winning party has their funds unlocked without being sent, while the losing party has their contract executed, transferring the payment to the winner. THNDR is already implementing a similar concept called “clinch” which we are glad we had some input on, but I want to take it a few steps further.

Exploring novel concepts in wagering -> community-to-community

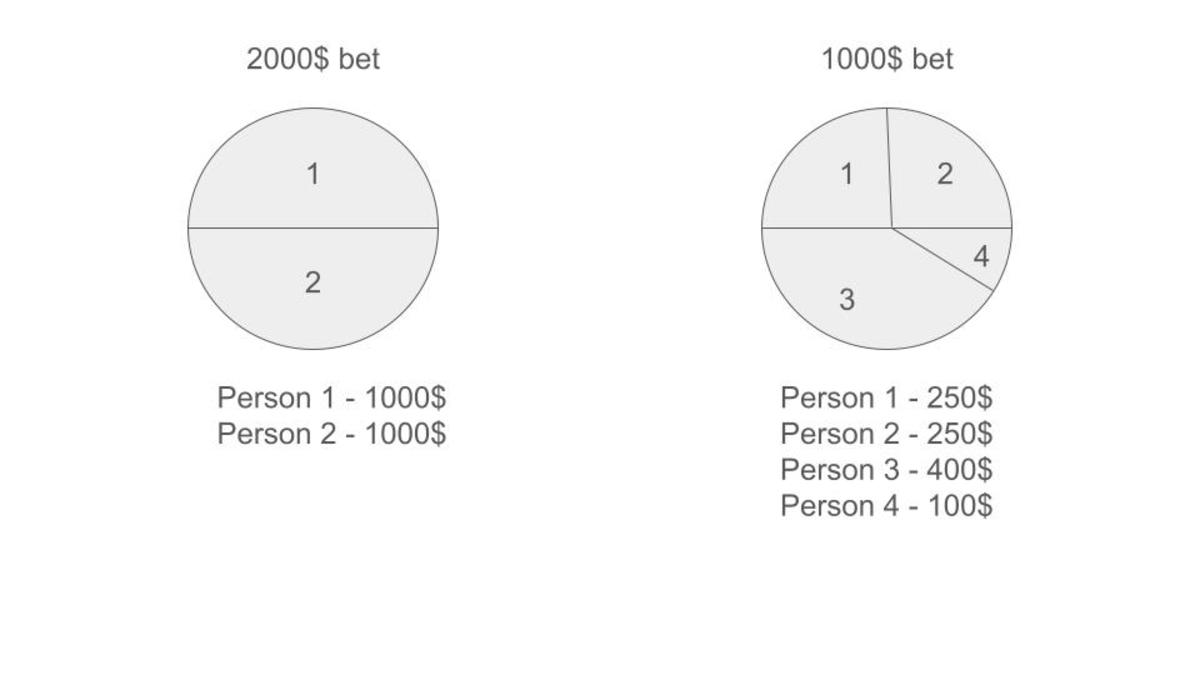

What if there’s a group of people on one side of the bet and another group on the opposing side? What does the payout look like, and how are the odds determined? Let’s delve into a straightforward graph to better illustrate this example.

The individuals on the left consist of only two people, but they wager a larger amount. On the right, there are four people, but their bets are smaller. If the left side wins, the two individuals will share the $1,000 bet placed by the opposing group. Since they bet equal amounts, each person will receive $500, reflecting a 50% stake for each. Conversely, if the right side wins, the stakes differ. Individuals 1 and 2 have a 25% stake, person 3 has a 40% stake, and person 4 has a 10% stake. Consequently, their respective payouts would be $500, $500, $800, and $200. That was a surprise even for me – there is a proof of stake system that I would be for. I realized that the staking is just not used in the proper context and that is why I have a problem with it. Proof of stake is deployed for bets and bets only. There is no such thing called staking your energy – that is called working. Now this system is not the shitcoin model – stake something and I guarantee you something more. Staking something means that going in you know (or you should know) that your stake could be lost. If someone is asking you to stake money and promising you more money you should ask yourself who is the loser that will pay the winner. If I am the winner, who is the loser? If we are all winners that means we all lost to inflation and the winner is the inflator. Stake = Bet.

The true stake system introduces a novel dimension to betting. While the primary goal is to win, participants might consider adding more funds to their community bet to avoid dilution. For instance, if I initially bet $10 alone, I would have a 100% payout potential. However, if someone else places a $10,000 bet on my side, my potential payout percentage drops to less than 0.1%. In such a scenario, I face two choices: increase my bet on my community’s side for a better payout or place a bet on the opposing side, capitalizing on the changed odds for a potentially significant payout if I am wrong. This concept sheds light on the genuine meaning of hedging. You are hedging things that you BET on! Whether you call it an investment strategy or not you should now recognize that everything in the fiat system is using these terms but hiding the fact that it is gambling. For example, if you are a true investor you should do everything you can to make your investment work and realize that goal. Betting against yourself = hedge.

The community-to-community betting brings about more significant implications than current betting models. In this setup, the victorious community directly benefits, and if the bet is placed on a sports event, the winning team supports the winning community. The funds from the losing team’s community are directly paid to the winning community and not to a betting company. This eliminates the intermediary role of any betting company. The people also are forced to do their research and assess which is a good bet and which is not – not that the majority do it. If they did it was going to be clear to all of us by now that all sh*tcoins are the fiat scam on a blockchain.

When there are three or more possible outcomes for a bet, multiple people or communities can bet on those outcomes, and all losing communities pay the winning community. In this scenario, individual participants receive payouts based on their respective stakes. For instance, in a bet involving predicting an exact score where no one bets on the correct score, there is no winner, and consequently, no actual losers. In such cases, participants simply have their sats unlocked without any winnings or losses.

We invest our energy in goals – make sure it is your goals and not someone else’s. With money, we do 3 things only – earning, spending, or gambling!

People want to pay you money so you achieve their goals and stake your money so you can lose it to them. Be very aware of where you invest your energy and how you are using your bitcoin. I would like to repeat my statement from above one more time. The forces that are involved with these gambling companies are very powerful and I do not want to inspire someone and put a target on their back. I am doing this because of the utility of the payments and because this can be an open-sourced project that just competes with them. Satoshi set a standard for how to solve a monopoly – with FOSS. This will completely reshape the coordination between humans again with instant settlement payment. I do not like that I am promoting betting behavior because it is addictive and dangerous but I hope this puts a light on why all fiat behavior is gambling. The only proof of stake that matters is what is your stake in Bitcoin from the 21 million coins. Having a stake there is betting on humanity for the better.

Now be careful with this bet to make that app!

This is a guest post by Ivan Makedonski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

#Instant #Settlement #Series #Gambling #Industry